3,500+

Five-Star Reviews

Waypoint is family-owned and has been serving Florida since 2005. Clients and industry professionals choose us for our attention to detail, customer service, and passion for what we do. We don’t just check boxes on a report; we ensure our clients feel confident and secure in their decisions.

Five-Star Reviews

Services Completed

Years in Business

Five-Star Reviews

Services Completed

Years in Business

Purchasing a home is one of the most significant investments you will make. A home inspection is crucial for an informed decision and peace of mind.

A commercial inspection is vital for assessing the property’s condition and gives you the clarity and confidence needed to ensure a sound investment.

Ensure your future home is constructed to your expectations by having an extra set of eyes and ears inspect the home during different phases of construction.

Sell your home faster and for more money by knowing the issues a buyer’s inspector may find and having the flexibility to fix them on your terms, or list them as-is.

If your home has certain features that help it withstand a hurricane, you may qualify for potentially significant homeowner’s insurance discounts.

Most insurance companies require a four-point report on homes over ten years old before they will provide homeowner’s coverage.

Although they are underground, the condition of sewer drains is your responsibility. Check for leaks, blockages, breaks, and wear.

An indoor air quality test can give you a heads-up if mold may be growing in areas that are not visible or hard to reach, like behind walls.

Long-term exposure to radon gas is the second leading cause of lung cancer in the US. Get a test to see if a property’s levels are below EPA limits.

Active duty and retired military, police, firefighter/EMT, nurses, and teachers receive a $50 discount to the home inspection.

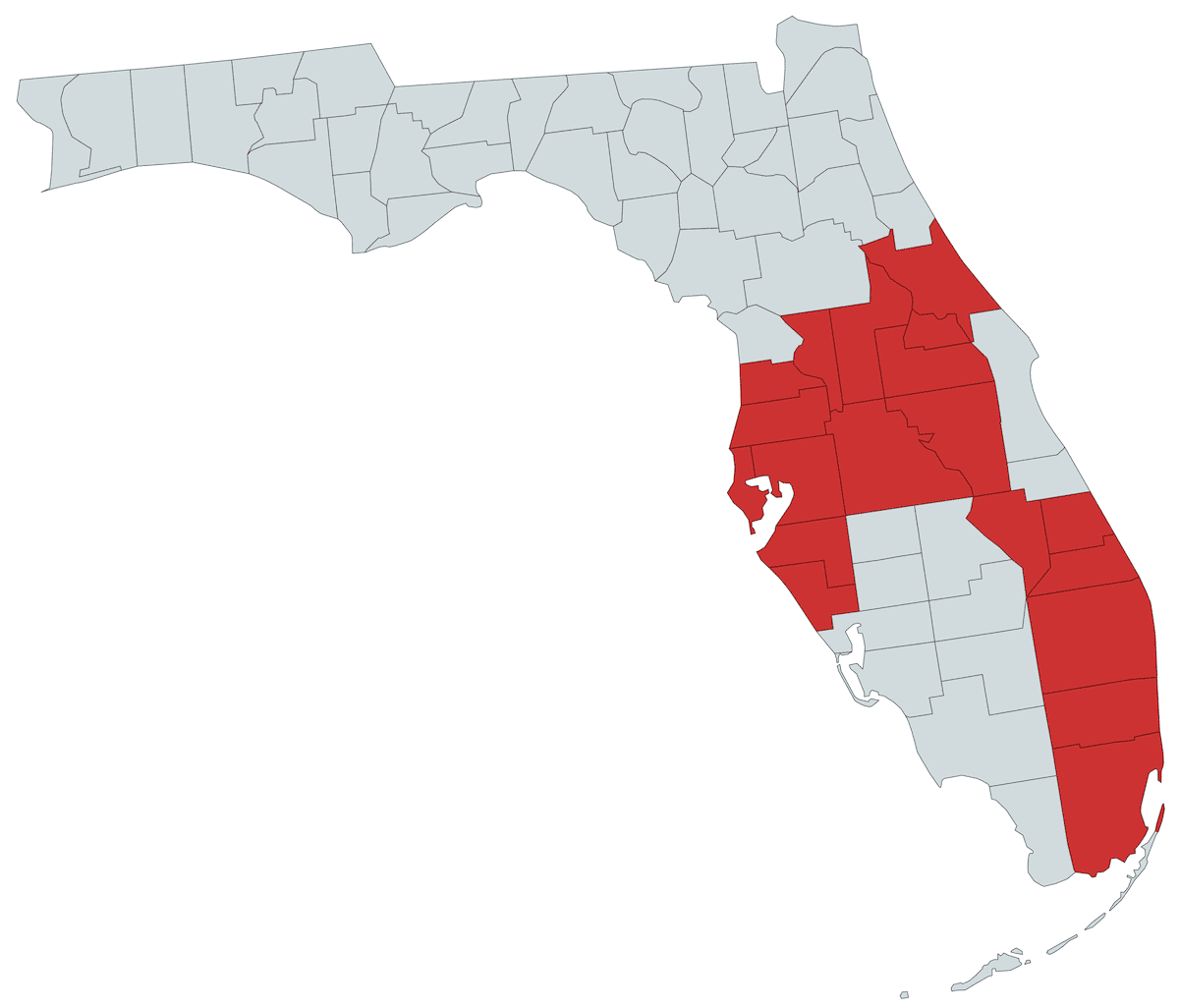

Schedule NowIncludes Hillsborough, Pasco, Pinellas, Hernando, Sarasota, Manatee, and Polk counties.

Key cities include:

Tampa | Brandon | Lakeland | St. Petersburg | Clearwater | Plant City | Wesley Chapel | Spring Hill | Bradenton | Sarasota | Venice | Port Charlotte | Brooksville | Largo | Pinellas Park | New Port Richey | Englewood | Dunedin | Lutz |

Includes Orange, Osceola, Seminole, Lake, Sumter, and Volusia counties.

Key cities include:

Orlando | Kissimmee | Clermont | Sanford | Altamonte Springs | Apopka | Ocoee | Oviedo | Winter Garden | Winter Park | Davenport | Leesburg | Winter Haven | St. Cloud | Lake Wales | Haines City |

Key cities include:

Boca Raton | Boynton Beach | West Palm Beach | Jupiter | Wellington | Lake Worth | Delray Beach | Gulf Stream | Highland Beach | Plantation | Hollywood | Weston | Hillsboro Beach | Lighthouse Point | Pompano Beach | Deerfield Beach | Coral Springs | Fort Lauderdale | Miami | Stuart | Fort Pierce | Homestead |